外匯交易時區指南

Forex Trading Time Zone Guide: Best Times to Trade EUR/USD, GBP/USD, USD/JPY (2025)

← Back to Time Zone Converter Complete Guide

Introduction: Why Time Zones Matter in Forex Trading

Missing the London-New York overlap cost you a winning EUR/USD trade? You're experiencing what professional forex traders know intimately—timing isn't just important in forex, it's everything. The foreign exchange market operates 24 hours a day, 5 days a week, but not all trading hours are created equal. 80% of forex volume concentrates in just 8 hours daily when major markets overlap.

Unlike stock markets that have fixed hours, forex trading follows the sun as major financial centers open and close: Sydney, Tokyo, London, and New York. Each session has distinct characteristics—Tokyo favors JPY pairs with moderate volatility, London brings massive EUR/GBP volume, and the London-New York overlap (8 AM - 12 PM EST) generates the highest liquidity and tightest spreads of the entire day.

Understanding forex time zones transforms your trading from guesswork into strategy. Knowing when EUR/USD spreads tighten from 2 pips to 0.5 pips, when GBP/USD volatility spikes 300% during London open, or when to avoid the "dead zone" between New York close and Tokyo open can mean the difference between consistent profits and frustrated losses.

This guide reveals professional strategies for trading across global time zones, optimal entry times for major currency pairs, and how to leverage market overlaps for maximum advantage.

⭐⭐⭐ Track Global Forex Market Hours with Our Free Time Zone Converter →

Understanding the 24-Hour Forex Market

The Four Major Trading Sessions

The forex market operates continuously from Sunday 5 PM EST (when Sydney opens) to Friday 5 PM EST (when New York closes), creating a seamless 24-hour trading environment. This continuous operation is divided into four major trading sessions:

1. Sydney (Australian) Session

- Trading Hours: 5:00 PM - 2:00 AM EST (Next Day)

- Peak Hours: 7:00 PM - 11:00 PM EST

- Timezone: Australian Eastern Standard Time (AEDT, UTC+11)

- Characteristics: Lowest volume, widest spreads, quietest session

- Active Pairs: AUD/USD, AUD/JPY, NZD/USD

- Typical Spread EUR/USD: 2-3 pips

2. Tokyo (Asian) Session

- Trading Hours: 7:00 PM - 4:00 AM EST

- Peak Hours: 11:00 PM - 3:00 AM EST

- Timezone: Japan Standard Time (JST, UTC+9)

- Characteristics: Moderate volume, JPY pairs dominate, influenced by Asian economic data

- Active Pairs: USD/JPY, EUR/JPY, AUD/JPY, GBP/JPY

- Typical Spread EUR/USD: 1.5-2 pips

3. London (European) Session

- Trading Hours: 3:00 AM - 12:00 PM EST

- Peak Hours: 3:00 AM - 9:00 AM EST

- Timezone: Greenwich Mean Time / British Summer Time (GMT/BST, UTC+0/+1)

- Characteristics: Highest single-session volume (~35% of daily forex volume), EUR and GBP pairs most active

- Active Pairs: EUR/USD, GBP/USD, EUR/GBP, USD/CHF

- Typical Spread EUR/USD: 0.5-1 pips

4. New York (US) Session

- Trading Hours: 8:00 AM - 5:00 PM EST

- Peak Hours: 8:00 AM - 12:00 PM EST (overlaps with London)

- Timezone: US Eastern Time (EST/EDT, UTC-5/-4)

- Characteristics: Second-highest volume (~20% of daily volume), major US economic releases impact all pairs

- Active Pairs: All major USD pairs, especially EUR/USD, GBP/USD, USD/CAD

- Typical Spread EUR/USD: 0.5-1 pips (during overlap); 1-1.5 pips (after London close)

⭐⭐ Learn More: US Time Zones Complete Guide →

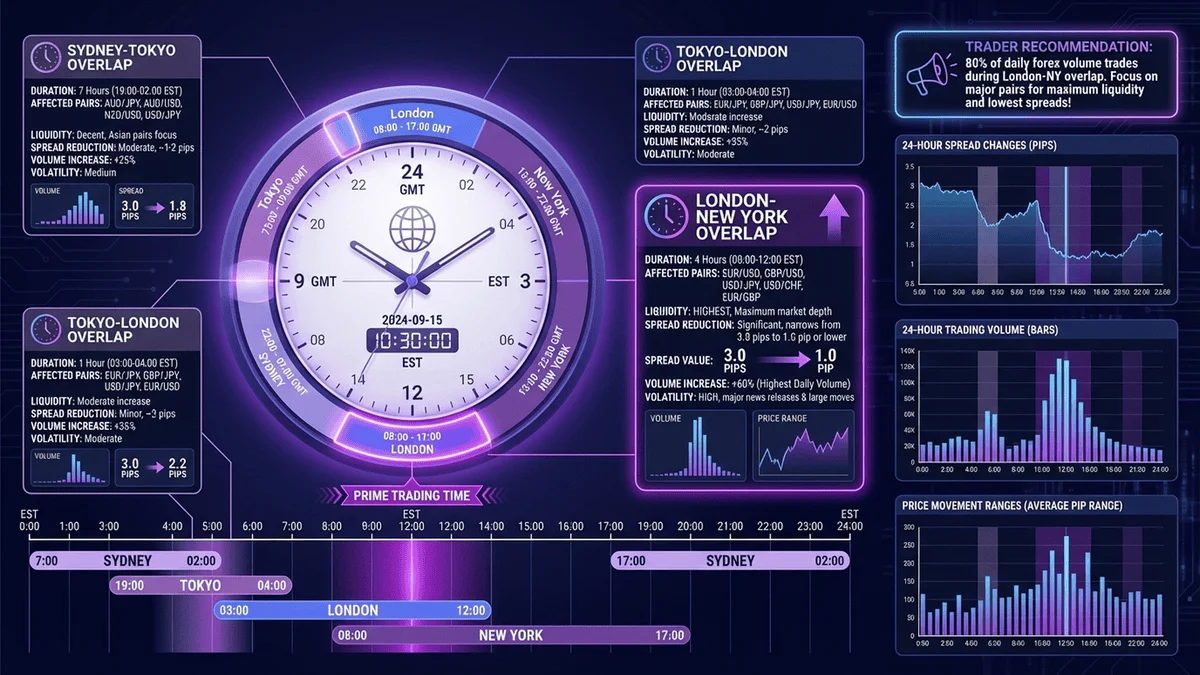

Session Overlaps: Where the Action Happens

The most profitable trading opportunities occur during session overlaps when two major markets are open simultaneously:

Tokyo-London Overlap

- Time: 3:00-4:00 AM EST

- Duration: 1 hour

- Volume: Moderate

- Best Pairs: EUR/JPY, GBP/JPY, AUD/JPY

- Strategy: Cross-currency pairs involving JPY and EUR/GBP

London-New York Overlap (Most Important)

- Time: 8:00 AM - 12:00 PM EST

- Duration: 4 hours

- Volume: 40-50% of daily forex volume

- Best Pairs: EUR/USD, GBP/USD, USD/CHF, USD/CAD

- Strategy: All strategies work; highest liquidity, tightest spreads, most volatility

Why Overlaps Matter:

- ✅ Increased liquidity: More traders = easier order execution

- ✅ Tighter spreads: Competition among brokers reduces costs

- ✅ Higher volatility: Larger price movements = more profit potential

- ✅ Better price discovery: More efficient market pricing

(插圖1標題)

24-Hour Forex Market Trading Sessions Timeline

(插圖1描述)

場景描述: A comprehensive horizontal timeline chart showing the four major forex trading sessions across a 24-hour period (displayed in EST time zone). The chart features four overlapping colored bands representing Sydney (light blue), Tokyo (yellow), London (red), and New York (green) sessions. Each band shows the full duration of that session, with darker/more saturated colors indicating peak trading hours. The critical London-New York overlap period (8 AM - 12 PM EST) is highlighted with a special vertical golden band crossing both the London and New York session bars. Below the main timeline, a volume indicator graph shows relative trading volume throughout the day, with the highest peak during the London-New York overlap. Time markers are clearly labeled every 2 hours (12 AM, 2 AM, 4 AM, etc.) along the bottom axis. Small cityscape silhouettes (Sydney Opera House, Tokyo Tower, Big Ben, Statue of Liberty) appear above their respective session bands for quick visual recognition.

視覺重點: The dramatic London-New York overlap period emphasized by the golden highlighting band; the clear visual contrast between high-volume periods (thick, saturated colors) and low-volume periods (thin, lighter colors); the continuous nature of 24-hour forex trading shown by overlapping bands with no gaps; the volume graph at bottom reinforcing when the best trading opportunities occur; easy scanning to quickly identify which sessions are active at any given EST time.

必須出現的元素: Four horizontal colored bands representing the four trading sessions; clear labels for each session (Sydney, Tokyo, London, New York) with their respective timezone codes; 24-hour timeline with EST time markers every 2 hours; vertical golden band highlighting the 8 AM-12 PM EST London-New York overlap; volume indicator graph below the main timeline showing relative market activity; small iconic landmark silhouettes (Sydney Opera House, Tokyo Tower, Big Ben, Statue of Liberty) identifying each session; legend explaining color coding and overlap periods; grid lines for easy time reading.

需要顯示的中文字:

- Session labels from left to right:

* "Sydney Session 5 PM - 2 AM EST (AEDT UTC+11)" (Font: bold sans-serif, Size: medium, Color: dark blue on light blue background)

* "Tokyo Session 7 PM - 4 AM EST (JST UTC+9)" (Font: bold sans-serif, Size: medium, Color: dark orange on yellow background)

* "London Session 3 AM - 12 PM EST (GMT/BST UTC+0/+1)" (Font: bold sans-serif, Size: medium, Color: white on red background)

* "New York Session 8 AM - 5 PM EST (EST/EDT UTC-5/-4)" (Font: bold sans-serif, Size: medium, Color: white on green background)

- Overlap highlight label: "BEST TRADING TIME: London-New York Overlap (8 AM - 12 PM EST) 40-50% of Daily Volume" (Font: bold, Size: large, Color: white text on golden background, Position: centered on the golden vertical band)

- Chart title: "24-Hour Forex Market: Global Trading Sessions in EST Time Zone" (Font: bold serif, Size: extra-large, Color: dark blue, Position: top center)

- Volume graph Y-axis label: "Relative Trading Volume" (Font: regular, Size: small, Color: gray, Position: left side of volume graph)

- X-axis time markers: "12 AM", "2 AM", "4 AM", "6 AM", "8 AM", "10 AM", "12 PM", "2 PM", "4 PM", "6 PM", "8 PM", "10 PM", "12 AM" (Font: small sans-serif, Size: small, Color: black)

- Legend items: "Peak Hours (Darker Color)", "Regular Hours (Lighter Color)", "Market Overlap", "High Volume Period" (Font: small, Size: small, Position: bottom-right)

顯示圖片/人物風格: Clean financial chart and infographic style; professional trading platform aesthetic; modern data visualization; educational diagram suitable for forex traders and financial publications; precise and accurate time representations; clear visual hierarchy emphasizing important information; optimized for both digital trading screens and print materials.

顏色調性: Sydney session: light blue (#64B5F6) for regular hours, deeper blue (#2196F3) for peak hours; Tokyo session: soft yellow (#FFD54F) for regular hours, vibrant yellow (#FFC107) for peak hours; London session: bright red (#EF5350) for regular hours, deeper red (#D32F2F) for peak hours; New York session: fresh green (#66BB6A) for regular hours, deeper green (#43A047) for peak hours; Overlap highlight: metallic gold (#FFD700) with 70% opacity; Volume graph: gradient from light gray (#E0E0E0) at low volume to dark blue (#1565C0) at high volume; Background: white (#FFFFFF) or very light gray (#FAFAFA); Grid lines: light gray (#EEEEEE); Text: dark gray (#212121); Overall: professional financial color scheme with clear differentiation between sessions.

避免元素: No spinning clocks or time-flying-by animations; no currency symbols floating around; no upward trend arrows or success symbols; no light bulbs or innovation icons; no gears or mechanical elements; no people or trader illustrations; no bull/bear market symbols; no candlestick charts (this is about sessions, not price action); no 3D effects or unnecessary gradients; no rocket ships or speed lines; avoid overly decorative elements; no abstract global connectivity symbols; keep design focused on clear time-based information.

Slug: forex-market-24-hour-trading-sessions-timeline-est

Best Times to Trade Major Currency Pairs

EUR/USD: The King of Forex

EUR/USD accounts for 23% of all forex trading volume, making it the most traded currency pair in the world. Its optimal trading times align with European and US business hours:

Prime Trading Windows:

1. London Open (3:00-4:00 AM EST)

- Volatility: Very High (50-80 pip average hourly range)

- Spread: 0.5-0.8 pips

- Opportunity: European traders return from overnight, reacting to news

- Strategy: Breakout trading on initial London move

2. London-New York Overlap (8:00 AM-12:00 PM EST) ⭐ BEST

- Volatility: Highest (60-100 pip average hourly range)

- Spread: 0.3-0.5 pips (tightest of the day)

- Opportunity: US economic data releases (8:30 AM EST), maximum liquidity

- Strategy: All strategies viable; scalping, day trading, news trading

3. US Session After London Close (12:00-3:00 PM EST)

- Volatility: Moderate (30-50 pip range)

- Spread: 0.8-1.2 pips

- Opportunity: US-specific news, afternoon position adjustments

- Strategy: Trend continuation or reversal trades

Times to Avoid EUR/USD:

- ❌ Sydney/Tokyo Sessions (5:00 PM - 3:00 AM EST): Low volume, wide spreads (1.5-2.5 pips), choppy price action

- ❌ Late NY Session (4:00-5:00 PM EST): Minimal volatility, position squaring before close

- ❌ Weekends (Friday 5 PM - Sunday 5 PM EST): Market closed, only specialist brokers offer quotes

GBP/USD: The High Volatility Pair

Known as "Cable," GBP/USD is the fourth most traded pair, famous for dramatic intraday swings reaching 100-150 pips. Best trading times:

Prime Trading Windows:

1. London Open (3:00-5:00 AM EST) ⭐ BEST FOR GBP

- Volatility: Extreme (80-120 pip average range)

- Spread: 0.8-1.2 pips

- Opportunity: UK economic releases (2:00 AM and 4:30 AM EST), market opens with gaps

- Strategy: Momentum trading, riding strong directional moves

2. London-New York Overlap (8:00 AM-11:00 AM EST)

- Volatility: Very High (70-110 pips)

- Spread: 0.6-1 pip

- Opportunity: US data impacts dollar side; continued from London session

- Strategy: Scalping during tight ranges, breakout when volatility spikes

3. Late London Session (10:00 AM-12:00 PM EST)

- Volatility: Moderate-High (50-80 pips)

- Spread: 0.8-1.5 pips

- Opportunity: London traders close positions before lunch

- Strategy: Reversal trading, fading extreme moves

GBP/USD Trader Warning: This pair's volatility cuts both ways. While 100-pip moves create profit opportunities, they also trigger stop losses quickly. Use wider stops (30-50 pips typical) and reduce position sizes compared to EUR/USD trades.

USD/JPY: The Asian Session Champion

USD/JPY is the second most traded pair (13.5% of volume), showing unique characteristics due to Tokyo's dominance:

Prime Trading Windows:

1. Tokyo Session (8:00 PM - 2:00 AM EST) ⭐ BEST FOR JPY

- Volatility: Moderate (30-50 pips)

- Spread: 0.5-0.8 pips

- Opportunity: Japanese economic data (6:50 PM and 8:30 PM EST releases), Bank of Japan activity

- Strategy: Range trading, technical level bounces

2. Tokyo-London Overlap (3:00-4:00 AM EST)

- Volatility: Moderate-High (40-60 pips)

- Spread: 0.4-0.6 pips

- Opportunity: European traders enter, dual-market liquidity

- Strategy: Breakout trading as London volatility hits JPY positions

3. London Session (3:00 AM-8:00 AM EST)

- Volatility: Moderate-High (40-70 pips)

- Spread: 0.4-0.7 pips

- Opportunity: European trading volume adds liquidity

- Strategy: Continuation of Tokyo trends or reversal trading

4. New York Session (8:00 AM-12:00 PM EST)

- Volatility: Moderate (35-55 pips)

- Spread: 0.5-0.8 pips

- Opportunity: US data affects dollar side

- Strategy: USD-driven moves, less about JPY specifically

USD/JPY Special Considerations:

- Risk-off moves: During market stress, JPY strengthens rapidly as safe haven (can move 200+ pips in hours)

- Bank of Japan interventions: Rare but dramatic; can reverse 300-500 pip moves in minutes

- Correlation: Strong negative correlation with equity markets (S&P 500 down = JPY up)

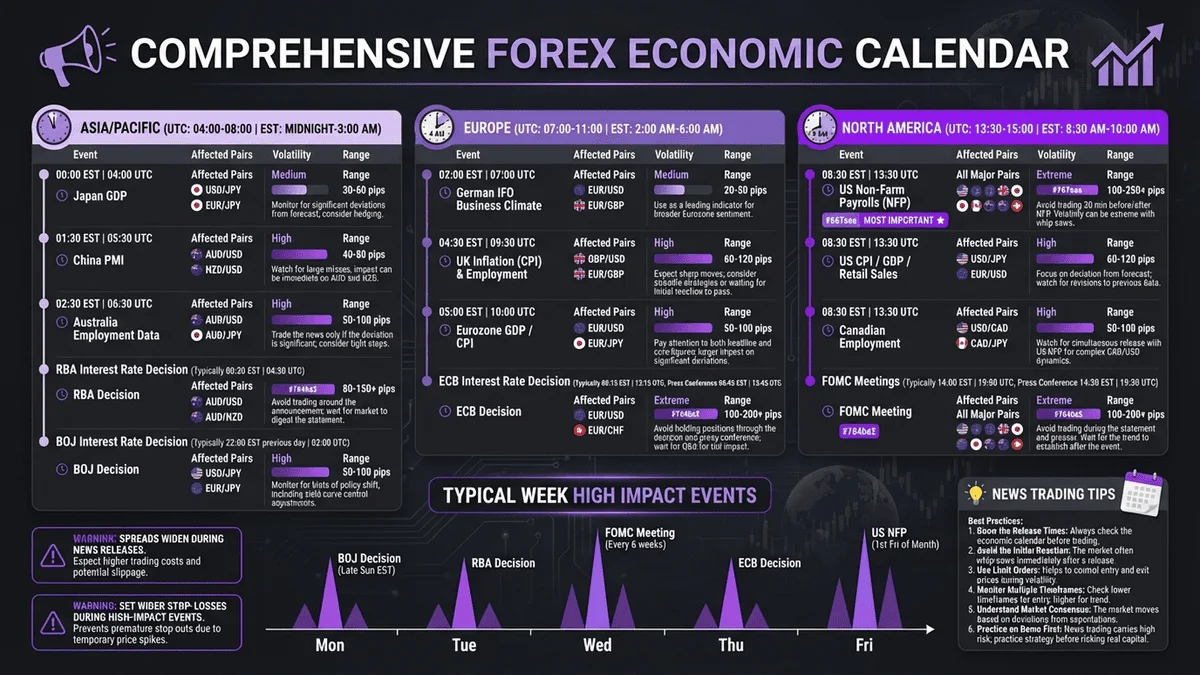

Market Overlap Trading Strategies

Strategy 1: London-New York Overlap Momentum Trading

The 8 AM-12 PM EST window offers the highest probability setups due to maximum liquidity and volatility.

Setup Requirements:

- Currency Pairs: EUR/USD, GBP/USD (primary); USD/CHF, USD/CAD (secondary)

- Timeframe: 5-minute or 15-minute charts

- Indicators: Moving Averages (20 EMA, 50 EMA), RSI, Volume

Entry Rules:

1. Identify pre-overlap trend (3-8 AM EST London session): Is EUR/USD trending up/down or ranging?

2. Wait for 8:30 AM EST (major US economic data release time)

3. Confirm momentum continuation: Price breaks previous hour high/low with increased volume

4. Enter on pullback: Don't chase; wait for 20 EMA retest on 5-min chart

5. Stop loss: 15-20 pips below entry for EUR/USD; 25-30 pips for GBP/USD

Exit Rules:

- Target 1 (50% position): 20-30 pips profit

- Target 2 (30% position): 40-60 pips profit

- Target 3 (20% position): Trail stop at 20 EMA until 12 PM EST London close

Why It Works: US economic data at 8:30 AM EST injects volatility into already-active London session, creating powerful directional moves. Combined liquidity from both markets reduces slippage and allows larger position sizes.

Strategy 2: Tokyo Range Breakout

The Tokyo session (8 PM-3 AM EST) typically establishes ranges that break during London open.

Setup Requirements:

- Currency Pairs: USD/JPY, AUD/JPY, EUR/JPY

- Timeframe: 1-hour charts

- Indicators: Support/Resistance levels, Bollinger Bands

Entry Rules:

1. Identify Tokyo range (8 PM-2 AM EST): Mark high and low of the range

2. Wait for London open (3 AM EST)

3. Breakout confirmation: Price closes above/below Tokyo range with strong candle (body > 50% of candle)

4. Enter on retest (optional conservative approach): Wait for pullback to broken level

5. Stop loss: Inside Tokyo range (10-15 pips below range low for long, above range high for short)

Exit Rules:

- Target: 1.5-2x the Tokyo range size

- Example: If Tokyo range was 40 pips, target 60-80 pip move

- Trail stop: Once up 30 pips, move stop to breakeven

Why It Works: Tokyo's lower volume creates consolidation. London's higher volume provides the catalyst to break and run. Classic breakout mechanics.

Strategy 3: Dead Zone Avoidance and Session Close Fading

The period between 4 PM-7 PM EST (after New York close, before Tokyo peaks) is the forex "dead zone"—lowest volume and directionality.

What NOT to Do:

- ❌ Don't initiate new positions (wide spreads, low liquidity)

- ❌ Don't expect strong directional moves (typical range: 10-20 pips)

- ❌ Don't use tight stops (random price fluctuations)

What TO Do (Advanced):

- Fade extreme moves from NY session: If EUR/USD moved 100+ pips during NY, expect 20-30% retracement during dead zone

- Use wide stops: 30-40 pip stops minimum due to low liquidity causing erratic price action

- Target small profits: 15-25 pips realistic; don't expect trending moves

Better Alternative: Stay out and wait for Tokyo session to establish direction (8 PM EST onward).

(插圖2標題)

Forex Trader Monitoring Multiple Currency Charts During London-New York Overlap

(插圖2描述)

場景描述: A professional forex day trader's workstation setup during the prime London-New York overlap hours (8 AM-12 PM EST). The scene shows a modern home office with three large monitors arranged in a curved configuration on a clean desk. The left monitor displays a EUR/USD 5-minute candlestick chart showing a strong uptrend with moving averages, the center monitor shows a live forex trading platform with multiple currency pair quotes (EUR/USD, GBP/USD, USD/JPY) with green/red price changes and tight spreads (0.5 pips), and the right monitor displays an economic calendar showing "US Non-Farm Payrolls - 8:30 AM EST" highlighted in red as a high-impact event. A male trader in his 30s wearing business casual attire (dress shirt, no tie) sits in an ergonomic chair, focused on the screens with one hand on a wireless mouse and the other hovering over the keyboard. On the desk: financial calculator, notepad with hand-written notes showing "EUR/USD Buy 1.0850 SL 1.0835 TP 1.0880", coffee mug, smartphone displaying a forex news app. Natural morning light streams through a window showing a city skyline in the background. Wall clock shows 10:30 AM.

視覺重點: The professional multi-monitor trading setup conveying serious trading activity; the clear uptrend on the EUR/USD chart suggesting a profitable trading opportunity; the economic calendar highlighting the importance of timing around news releases; the trader's focused body language showing concentration and decision-making; the hand-written trading notes demonstrating disciplined planning; the morning time (10:30 AM) placing us firmly in the optimal London-New York overlap period; realistic trading environment that forex traders would recognize.

必須出現的元素: Three computer monitors in curved arrangement; left monitor showing candlestick chart with clear uptrend, moving average lines (marked as 20 EMA and 50 EMA), and volume bars at bottom; center monitor displaying forex trading platform interface with currency pair list (EUR/USD 1.0865, GBP/USD 1.2745, USD/JPY 148.32) and bid/ask spreads; right monitor showing economic calendar with date, time, event name, and impact level; male trader seated at desk actively trading; ergonomic office chair; wireless keyboard and mouse; financial calculator; notepad with visible hand-written trade plan; coffee mug; smartphone; desk lamp; wall clock showing 10:30 AM; window with morning daylight and city buildings visible; professional home office environment.

需要顯示的中文字:

- Left monitor chart header: "EUR/USD - 5 Minute Chart" with timestamp "March 13, 2025 - 10:30 AM EST" (Font: trading platform font, Size: small, Color: white on dark background, Position: top of chart)

- Left monitor indicators: "20 EMA" on red line, "50 EMA" on blue line (Font: small sans-serif, Size: tiny, Color: matching line colors)

- Center monitor quote display: "EUR/USD 1.0865 ▲ Spread: 0.5" (green up arrow), "GBP/USD 1.2745 ▼ Spread: 0.8" (red down arrow), "USD/JPY 148.32 ▲ Spread: 0.6" (green up arrow) (Font: trading platform font, Size: medium, Color: green for up, red for down, Position: center of screen in rows)

- Right monitor calendar header: "Economic Calendar - High Impact Events" (Font: bold sans-serif, Size: medium, Color: white on dark blue header bar)

- Right monitor event: "8:30 AM EST - US Non-Farm Payrolls" with red "HIGH IMPACT" label (Font: bold, Size: medium, Color: red label, black text)

- Notepad visible text: "EUR/USD Buy 1.0850, SL: 1.0835, TP: 1.0880, London-NY Overlap Strategy" (Font: handwritten style, Size: medium, Color: blue ink, Position: visible on notepad)

- Wall clock: Shows 10:30 with "AM EST" label (Font: clean sans-serif, Size: medium, Color: black on white clock face)

顯示圖片/人物風格: Photorealistic contemporary photography; professional trading environment; authentic representation of a modern forex day trader's workspace; genuine focused expression showing concentration; natural posture and hand positions for active trading; high-quality lighting with natural window light supplemented by desk lamp; clean and organized workspace conveying professionalism; relatable and aspirational for forex traders.

顏色調性: Monitor displays: dark backgrounds (#1E1E1E) with bright charts and data for eye comfort; Candlestick chart: green candles for uptrends (#4CAF50), red for downtrends (#F44336), dark gray background (#2C2C2C); Quote display: bright green (#00E676) for rising prices, bright red (#FF1744) for falling prices, white text (#FFFFFF) for pair names; Economic calendar: dark blue header (#1565C0), white background (#FFFFFF) for calendar grid, red tags (#F44336) for high impact; Desk and office: natural wood tones (#8D6E63), light gray walls (#F5F5F5), warm morning sunlight (golden hour tones #FFF8DC); Overall: professional trading environment color scheme optimized for long hours of screen time.

避免元素: No glowing charts or futuristic holographic displays; no floating currency symbols or money icons; no arrows pointing upward to suggest guaranteed profits; no rocket ships or moon references; no Lamborghinis or wealth symbols; no stacks of cash or gold bars; no abstract success symbols like light bulbs or gears; no superhero capes or dramatic effects; avoid "get rich quick" imagery; no casino or gambling elements; no overly dramatic facial expressions or celebrations; no messy or chaotic workspace (maintain professionalism); avoid outdated technology or equipment.

Slug: forex-trader-monitoring-charts-london-new-york-overlap

Time Zone Conversion Tools for Traders

Essential Features for Forex Traders

Generic time zone converters don't meet forex traders' specialized needs. Look for these features:

Must-Have:

- ✅ Forex session markers: Visual indicators showing Sydney/Tokyo/London/NY sessions

- ✅ Market open/close alerts: Notifications when major sessions begin

- ✅ Multiple timezone display: Show 3-4 timezones simultaneously (EST, GMT, JST, AEDT)

- ✅ Economic calendar integration: Highlight high-impact news release times

- ✅ DST automatic adjustment: Forex never stops for Daylight Saving Time confusion

Advanced Features:

- 🎯 Pip volatility indicators: Show average pip range by hour

- 🎯 Spread tracking: Display typical spreads for different sessions

- 🎯 Session overlap highlighting: Visual emphasis on London-NY overlap

- 🎯 Historical volatility data: Compare current hour to historical averages

⭐⭐⭐ Use Our Forex-Optimized Time Zone Converter Tool →

Recommended Tools for Forex Traders

| Tool | Best For | Forex-Specific Features | Price |

|---|---|---|---|

| Forex Market Hours | Session tracking | Visual session clock, volatility heat map | Free |

| MetaTrader 4/5 | All-in-one | Built-in session markers, economic calendar | Free (with broker) |

| TradingView | Charting + time | Session indicators, multi-timezone charts | Free-$59.95/mo |

| Forex Factory Calendar | News timing | Economic event scheduler with timezone conversion | Free |

| Our Time Zone Converter | Quick conversion | Multi-zone display, no signup | Free |

Trading Across Daylight Saving Time Changes

Challenge: Different regions transition to DST on different dates:

- US/Canada: Second Sunday in March, first Sunday in November

- Europe: Last Sunday in March, last Sunday in October

- Australia: First Sunday in October, first Sunday in April

- Japan: No DST

Impact on Trading:

- London-NY overlap shifts by 1 hour for 2-3 weeks in March and October

- Broker platform times may or may not adjust (depends on broker timezone)

- Economic data release times stay consistent in their local timezone

Solution:

1. Use UTC reference: London session always opens at 8:00 AM GMT (or 7:00 AM BST during UK DST)

2. Check broker timezone: MT4/MT5 platforms often use GMT+2 or GMT+3; understand your broker's convention

3. Update calendars manually: Don't rely on recurring calendar events; update when DST changes

4. Follow economic calendar tools: Forex Factory and similar automatically adjust news times

⭐⭐ Related: Understanding UTC Time Zone →

Common Forex Trading Time Zone Mistakes

Mistake 1: Trading Outside Your Strategy's Optimal Session

Scenario: You have a scalping strategy designed for high liquidity (tested during London-NY overlap), but you use it during Tokyo session because you're awake then.

Why It Fails:

- Different sessions have different characteristics (volatility, spread, liquidity)

- Tokyo's 30-pip average hourly range doesn't support strategies requiring 50-pip moves

- Spreads widen from 0.5 pips to 1.5 pips, eating into scalping profits

Solution:

- Match your strategy to appropriate session

- Develop different strategies for different sessions

- Use forward-tested results specific to each session's characteristics

- If you must trade Tokyo from US timezone, create Tokyo-specific strategies (range trading, not momentum)

Mistake 2: Ignoring Economic Data Release Times

Scenario: You enter a EUR/USD trade at 8:25 AM EST, unaware that US Non-Farm Payrolls releases at 8:30 AM.

Why It Fails:

- High-impact news can move EUR/USD 100+ pips in seconds

- Spreads widen dramatically during releases (0.5 pips → 5-10 pips)

- Stop losses get triggered by volatility spikes that then reverse

Major Release Times (EST):

- US Data: 8:30 AM (employment, CPI, retail sales); 10:00 AM (consumer confidence, housing)

- European Data: 3:00-5:00 AM (CPI, GDP, PMI from various EU countries)

- UK Data: 2:00 AM and 4:30 AM (employment, CPI, Bank of England statements)

- Japanese Data: 6:50 PM and 8:30 PM (GDP, Tankan survey, trade balance)

Solution:

- Check economic calendar every morning before trading

- Avoid entering positions 5-10 minutes before high-impact releases

- Either trade the news deliberately (with proper strategy) or stay out entirely

- Set wider stops if holding through data releases (or close positions)

Mistake 3: Misjudging Weekend Gap Risk

Scenario: You hold a USD/JPY position over the weekend. Markets open Sunday 5 PM EST with a 150-pip gap due to North Korean missile test over weekend.

Why It Happens:

- Forex closes Friday 5 PM EST but world events don't stop

- Sydney opens Sunday 5 PM EST with price reflecting weekend news

- Gaps can be 50-300 pips depending on event severity

- Your stop loss doesn't work (market jumps past it)

High-Risk Events for Weekend Gaps:

- Geopolitical crises (military actions, terrorist attacks)

- Emergency central bank meetings or statements

- Natural disasters affecting major economies

- Elections and political upheavals

Solution:

- Close all positions before Friday 5 PM EST unless you accept gap risk

- Use extremely wide stops if you must hold (100+ pips)

- Reduce position size to account for gap potential

- Avoid holding CHF/JPY over weekends (safe havens gap most dramatically)

(插圖3標題)

Forex Trading Session Clock with Volatility Heat Map

(插圖3描述)

場景描述: A circular 24-hour clock diagram designed specifically for forex traders, divided into 24 segments (one per hour) arranged in a circle like a traditional clock face. Each hour segment is color-coded based on typical volatility levels: deep red for highest volatility hours (London-New York overlap), bright orange for high volatility, yellow for moderate, light green for low, and pale blue for the quietest hours. The clock face shows four distinct arcs on the outer ring labeled with the major trading sessions: Sydney (light blue arc), Tokyo (yellow arc), London (red arc), and New York (green arc), with overlap periods clearly marked where arcs intersect. In the center of the clock, a volatility key shows "EUR/USD Average Pip Range by Hour" with example values. Three small indicators on the clock highlight critical times: "London Open 3 AM EST" with bell icon, "NY Open 8 AM EST" with bell icon, and "London-NY Overlap" with star icon. The clock includes both 12-hour (AM/PM) and 24-hour time formats for trader reference. Professional, clean design optimized for quick decision-making.

視覺重點: The intuitive circular clock format that traders can quickly scan; the dramatic color gradient from pale blue (dead zone) through yellow/orange to deep red (peak volatility) visually communicating the best trading times; the clear session arcs on the outer ring showing when each major market is active; the highlighted London-New York overlap period as the "golden zone" for trading; educational yet practical design that serves as both learning tool and quick reference during live trading.

必須出現的元素: Circular clock face divided into 24 equal segments (one per hour); color-coded segments ranging from pale blue (lowest volatility) through light green, yellow, orange, to deep red (highest volatility); outer ring with four labeled arcs showing Sydney, Tokyo, London, and New York trading sessions; session arcs should visibly overlap where appropriate (Tokyo-London, London-New York); hour markers in both 12-hour format with AM/PM and 24-hour format; center legend showing "EUR/USD Avg Hourly Range" with example pip values (e.g., "Dead Zone: 10-15 pips, Tokyo: 30-40 pips, London: 50-70 pips, London-NY Overlap: 80-100 pips"); small bell icons marking session open times; star icon marking the optimal overlap period; clean typography and professional layout.

需要顯示的中文字:

- Clock title: "Forex Trading Session Clock - EST Time Zone" (Font: bold serif, Size: large, Color: dark blue, Position: top center above clock)

- Outer arc labels clockwise from bottom:

* "Sydney Session 5 PM - 2 AM EST" (Font: bold, Size: small, Color: dark blue on light blue background)

* "Tokyo Session 7 PM - 4 AM EST" (Font: bold, Size: small, Color: dark orange on yellow background)

* "London Session 3 AM - 12 PM EST" (Font: bold, Size: small, Color: white on red background)

* "New York Session 8 AM - 5 PM EST" (Font: bold, Size: small, Color: white on green background)

- Overlap indicator: "Peak Liquidity: 8 AM-12 PM EST" with star icon (Font: bold, Size: medium, Color: white on gold background, Position: between London and NY arcs)

- Center legend title: "EUR/USD Volatility by Hour" (Font: bold, Size: medium, Color: black)

- Center pip range examples:

* "Dead Zone (4-7 PM EST): 10-15 pips/hour" (Font: regular, Size: small, Color: pale blue matching that zone)

* "Tokyo (8 PM-3 AM EST): 30-40 pips/hour" (Font: regular, Size: small, Color: yellow)

* "London (3 AM-8 AM EST): 50-70 pips/hour" (Font: regular, Size: small, Color: orange)

* "Overlap (8 AM-12 PM EST): 80-100 pips/hour" (Font: regular, Size: small, Color: deep red)

- Hour markers around the clock: "12 AM", "1 AM", "2 AM", etc. (Font: small sans-serif, Size: small, Color: black, Position: inside each hour segment)

- Small annotation: "Bell icon = Session Open, Star = Best Trading Time" (Font: tiny, Size: tiny, Color: gray, Position: bottom of clock)

顯示圖片/人物風格: Clean infographic and data visualization style; professional financial chart design; modern and minimalist aesthetic; educational diagram optimized for trader decision-making; flat design with subtle gradients only in the volatility color scale; precision and clarity prioritized over decorative elements; suitable for both digital trading platforms and printed reference materials.

顏色調性: Volatility heat map gradient: pale blue (#E3F2FD) for lowest volatility → light green (#C8E6C9) → soft yellow (#FFF9C4) → bright orange (#FFCC80) → deep red (#EF5350) for highest volatility; Session arcs: Sydney light blue (#64B5F6), Tokyo yellow (#FFC107), London red (#F44336), New York green (#66BB6A), overlap areas use gold (#FFD700); Background: white (#FFFFFF) or very light gray (#FAFAFA); Text: dark gray (#424242) for readability; Bell icons: bright yellow (#FFD700); Star icon: gold (#FFD700) with slight glow effect; Overall: professional trading color scheme with clear visual hierarchy using color intensity to communicate volatility levels.

避免元素: No spinning clock hands or animated time effects; no currency symbols floating around the clock; no upward arrows or trend indicators; no light bulbs or innovation symbols; no gears or mechanical elements; no 3D perspective or unnecessary depth effects; no people or trader illustrations; no bull/bear symbols; no candlestick charts (this is about session timing, not price); no money symbols or profit indicators; no rocket ships or speed lines; avoid cluttered design with too many data points; no abstract global connectivity visuals; keep laser-focused on session timing and volatility information.

Slug: forex-trading-session-clock-volatility-heat-map-est

Frequently Asked Questions (FAQ)

1. What is the best time to trade forex?

The best time to trade forex is during the London-New York overlap (8:00 AM - 12:00 PM EST), when 40-50% of daily forex volume occurs. This 4-hour window offers the tightest spreads (0.3-0.5 pips for EUR/USD), highest liquidity, and most significant price movements (60-100 pips average hourly range). For EUR/USD and GBP/USD traders, this is the optimal period. Asian session traders should focus on Tokyo hours (8:00 PM - 2:00 AM EST) for USD/JPY and JPY crosses.

2. What time does the forex market open and close?

The forex market opens Sunday 5:00 PM EST (when Sydney opens) and closes Friday 5:00 PM EST (when New York closes), creating a continuous 24-hour, 5-day-per-week trading environment. However, specific trading sessions have distinct hours: Sydney (5 PM-2 AM EST), Tokyo (7 PM-4 AM EST), London (3 AM-12 PM EST), and New York (8 AM-5 PM EST). Markets are closed from Friday 5 PM to Sunday 5 PM EST each week.

3. Why are spreads wider during certain forex sessions?

Spreads widen during low-liquidity periods (like the "dead zone" between 4-7 PM EST after New York closes and before Tokyo peaks) because fewer market participants means less competition among liquidity providers. During peak sessions like the London-New York overlap, hundreds of banks and institutions compete to offer the best prices, compressing spreads to 0.3-0.5 pips for EUR/USD. During Sydney session, spreads can reach 2-3 pips for the same pair due to minimal volume.

4. Should I trade forex during the Asian session from the US?

Only if you develop Asia-session-specific strategies. The Tokyo session (7 PM-4 AM EST) has fundamentally different characteristics than London/NY: lower volatility (30-50 pip average ranges), wider spreads, and range-bound price action. Strategies designed for London's breakout trading won't work in Tokyo's range environment. If you're in the US and must trade Tokyo hours, focus on USD/JPY, AUD/JPY, and other Asia-Pacific pairs using range-trading strategies.

5. What happens to forex prices over the weekend?

Forex markets close Friday 5:00 PM EST and reopen Sunday 5:00 PM EST, but world events continue. If significant news occurs over the weekend (geopolitical events, natural disasters, emergency central bank actions), the market reopens with a gap—the price jumps from Friday's close to Sunday's open, sometimes 50-300 pips away. Your stop losses don't activate during this gap; the market simply opens beyond your stop level, resulting in larger-than-intended losses. This is why many traders close positions before weekends.

6. How do I convert forex trading times to my local timezone?

Use a forex-specific time zone converter that displays multiple major sessions (EST, GMT, JST, AEDT) simultaneously. Our free time zone converter tool is optimized for traders. Key conversion: London session opens at 3:00 AM EST / 8:00 AM GMT / 5:00 PM JST / 7:00 PM AEDT. The London-New York overlap is 8:00 AM-12:00 PM EST / 1:00 PM-5:00 PM GMT. Remember that Daylight Saving Time shifts these by 1 hour during transitions (March-April and October-November).

7. Which currency pairs are best to trade during London session?

EUR/USD and GBP/USD dominate London session trading, accounting for over 50% of volume during European hours. These pairs see their highest volatility and tightest spreads during London hours (3:00 AM-12:00 PM EST). EUR/GBP is exclusively a London play, as both currencies are European. USD/CHF also sees significant London activity. Avoid trading AUD/USD or NZD/USD during London—their optimal times are during Sydney/Tokyo sessions when Australian markets are active.

8. How does Daylight Saving Time affect forex trading?

DST changes create temporary misalignments between major sessions because different regions transition on different dates. For example, when the US enters DST in March but Europe hasn't yet transitioned, the London-New York overlap shortens by 1 hour for 2-3 weeks. Japan doesn't observe DST at all, so the Tokyo-London overlap shifts permanently when UK changes clocks. Use UTC-based timing to avoid confusion: London always opens at 08:00 GMT (07:00 BST during UK summer time), regardless of US DST status.

9. What is the quietest time in forex trading?

The "dead zone" between 4:00-7:00 PM EST is the quietest forex period. After New York closes (5 PM EST) and before Tokyo peaks (8 PM EST), volume drops to daily lows. Sydney is open but accounts for less than 5% of global volume. During this window, EUR/USD spreads widen to 1.5-2.5 pips, average hourly range drops to 10-15 pips, and price action becomes choppy and directionless. Professional traders either avoid this period entirely or use it only for mean-reversion strategies with wide stops.

10. Can I scalp forex during all trading sessions?

No—scalping requires tight spreads and high liquidity, available only during major sessions (especially London-New York overlap). During Sydney session, EUR/USD spreads of 2-3 pips make scalping unprofitable; you'd need 5-6 pip moves just to break even. Successful scalpers focus on the London open (3-5 AM EST) and London-NY overlap (8 AM-12 PM EST) when EUR/USD spreads compress to 0.3-0.5 pips and volatility provides 60-100 pip hourly ranges. If you must scalp outside these hours, switch to long-term strategies or sit out.

11. How do economic news releases interact with trading sessions?

Major economic data releases are timed to each region's market hours: US data releases at 8:30 AM and 10:00 AM EST (during NY session), UK data at 2:00 AM and 4:30 AM EST (during London session), and Japanese data at 6:50 PM and 8:30 PM EST (during Tokyo session). The most volatile events occur when high-impact US data releases during the London-New York overlap (8:30 AM EST Non-Farm Payrolls, CPI, FOMC) because both markets are active, multiplying the volatility impact. Check economic calendars daily to avoid unexpected volatility.

12. What forex trading strategy works best for each session?

Match your strategy to session characteristics: Tokyo (7 PM-4 AM EST) favors range trading and technical level bounces due to lower volatility and defined ranges; London (3 AM-12 PM EST) excels for breakout and momentum strategies as European volume creates strong directional moves; London-NY Overlap (8 AM-12 PM EST) supports all strategies (scalping, day trading, news trading) due to maximum liquidity; Late NY (12 PM-5 PM EST) suits mean-reversion and counter-trend strategies as trends exhaust. Avoid using momentum strategies during Sydney/dead zone hours—they'll fail due to insufficient volatility.

Conclusion: Timing Is Everything in Forex

Key Takeaways

Forex trading success isn't just about what you trade or how you trade—when you trade determines 60% of your profitability potential:

-

The London-New York overlap (8 AM-12 PM EST) is the golden window: 40-50% of daily volume, 0.3-0.5 pip spreads, and 60-100 pip hourly ranges create ideal conditions for all trading strategies.

-

Match your strategy to the session: Momentum and breakout strategies thrive during London/NY hours; range-trading strategies work in Tokyo; scalping requires London-NY overlap liquidity; mean-reversion suits late NY session.

-

Avoid the dead zone (4-7 PM EST): After New York closes and before Tokyo peaks, spreads widen 3-5x, volatility drops 70%, and price action becomes unpredictable. Stay out or trade entirely different strategies.

-

Economic data releases amplify session volatility: US data at 8:30 AM EST during London-NY overlap creates explosive moves (100+ pips in minutes). Either trade the news deliberately with proper preparation or stay out completely—there's no middle ground.

-

Use forex-specific time zone tools: Generic converters don't show session overlaps, volatility patterns, or economic event timing. Specialized forex tools save hours of calculation and prevent costly timing errors.

The forex market's 24/5 operation creates an illusion that you can trade anytime. The reality: 80% of opportunities concentrate in 33% of trading hours (London and London-NY overlap periods). Professional traders structure their schedules around these high-probability windows rather than forcing trades during sub-optimal hours.

Your Action Plan

Immediate Steps:

- 🕐 Identify your available trading hours and match them to appropriate forex sessions

- 📊 Backtest your strategies by session to verify they work during the hours you can trade

- 🔔 Set session alerts for London open (3 AM EST) and London-NY overlap start (8 AM EST)

Weekly Routine:

- 📅 Check economic calendar every Sunday night for the week's high-impact news

- 🎯 Plan which sessions you'll trade based on your schedule and strategy

- 📝 Journal trades by session to identify your highest-win-rate hours

Long-term Development:

- 🧪 Develop session-specific strategies: one for London, one for Tokyo, one for overlaps

- 📊 Track performance by session to focus on your most profitable times

- 🔄 Adjust your schedule (if possible) to align with your best-performing sessions

The difference between break-even traders and consistently profitable traders often comes down to session selection. When you trade during London-NY overlap with appropriate strategies, you're competing with favorable odds. Trading during Sydney session with London-optimized strategies puts you at immediate disadvantage before you even enter a position.

⭐⭐⭐ Start Tracking Forex Sessions with Our Free Time Zone Tool →

Master the timing, and you've solved half the forex puzzle. The rest—strategy, risk management, psychology—becomes dramatically easier when you're trading during high-probability hours with tight spreads and predictable volatility patterns.

Related Resources

- Time Zone Converter Complete Guide - Master all aspects of time zone conversion

- Meeting Planner for Global Teams - Coordinate across multiple time zones

- US Time Zones Guide - Understanding EST, PST, and DST for NY session

- UTC Time Zone Guide - Use UTC as stable reference for forex timing

- Browse All Conversion Tools - Explore our complete suite of conversion utilities